OZAN KOSE/AFP via Getty Images

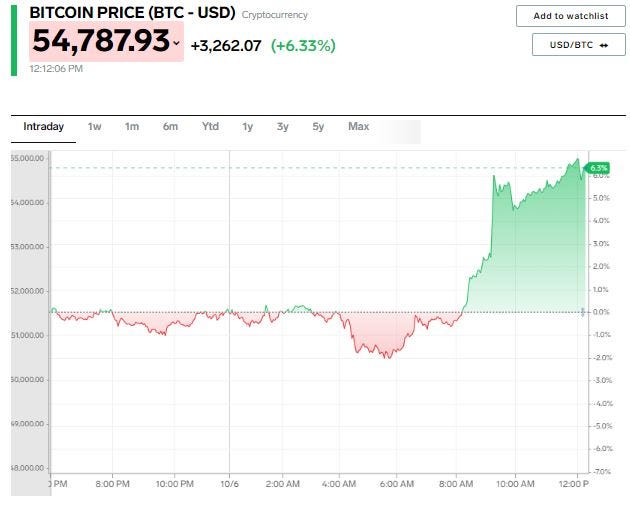

- Bitcoin rallied as much as 8% on Wednesday, helping the cryptocurrency reclaim its $1 trillion valuation.

- The price has surged more than 30% over the past week as concerns about Congress' ability to raise the US debt ceiling grow.

- If bitcoin can stay above the $52,900 resistance level, its next target will be the prior record high of about $65,000.

- Sign up here for our daily newsletter, 10 Things Before the Opening Bell.

Bitcoin's 34% rally over the past week has once again catapulted the cryptocurrency to a more than $1 trillion market valuation for the first time since May 10, according to data from CoinMarketCap.

The surge in bitcoin has come amid ongoing concerns surrounding Congress' potential inability to raise the US debt ceiling before the Treasury department runs out of money on October 18.

That potential economic catastrophe would only validate the foundation of bitcoin, which was created to be a decentralized form of money that is not influenced by decision makers in Washington, D.C.

Bitcoin's Wednesday rally of as much as 8% also helped push the trillion-dollar crypto coin above its prior resistance level of $52,900, an important level monitored by technical analyst Katie Stockton of Fairlead Strategies.

If bitcoin manages to decisively hold above that level for at least two consecutive daily closes, it would clear the path for bitcoin to retest its mid-April record high of about $65,000, representing potential upside of 20% from current levels.

"We expect short-term overbought conditions to be weathered long enough for a test of minor resistance near $52.9K, a breakout above which would target the all-time high," Stockton explained in a Tuesday note, before bitcoin's rally got it above the key resistance level.

And now, momentum is on bitcoin's side, with short-, intermediate-, and long-term momentum indicators all in positive territory as of Tuesday, she said.

While Stockton doesn't expect support levels to be tested in the near-term, she does highlight the first likely support level of $46,700, representing potential downside of 15% from current prices.